Category: CyberFinance

-

Bitpanda Ecosystem Token (BEST): Revolutionizing Digital Asset Trading!

•

The Bitpanda Ecosystem Token (BEST) is a noteworthy development in the world of digital asset trading. Launched by Bitpanda, a leading European digital asset platform, BEST operates on the Ethereum blockchain and offers a range of benefits and rewards to its holders. This article delves into the details, functionalities, and…

-

BlackRock’s Optimism for Spot Bitcoin ETF Approval On Wednesday: A Fox Business Report!

•

BlackRock, the world’s largest asset manager, is reportedly expecting its Spot Bitcoin Exchange-Traded Fund (ETF) to receive approval from the U.S. Securities and Exchange Commission (SEC) on Wednesday, according to a report by Fox Business. This development, if confirmed, could mark a significant milestone in the integration of cryptocurrencies into…

-

Clickbait? In-Depth Analysis: Matrixport Analyst Foresees SEC’s Likely Rejection of Bitcoin Spot ETFs in January!

•

In a recent statement, an analyst from Matrixport predicted that the U.S. Securities and Exchange Commission (SEC) would reject all Bitcoin spot Exchange-Traded Funds (ETFs) applications in January. However, this perspective might be overly pessimistic, considering the evolving regulatory landscape and the SEC’s recent approaches. This article explores the reasons…

-

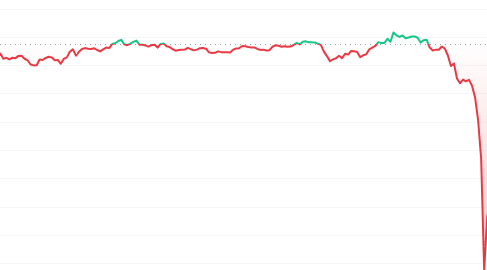

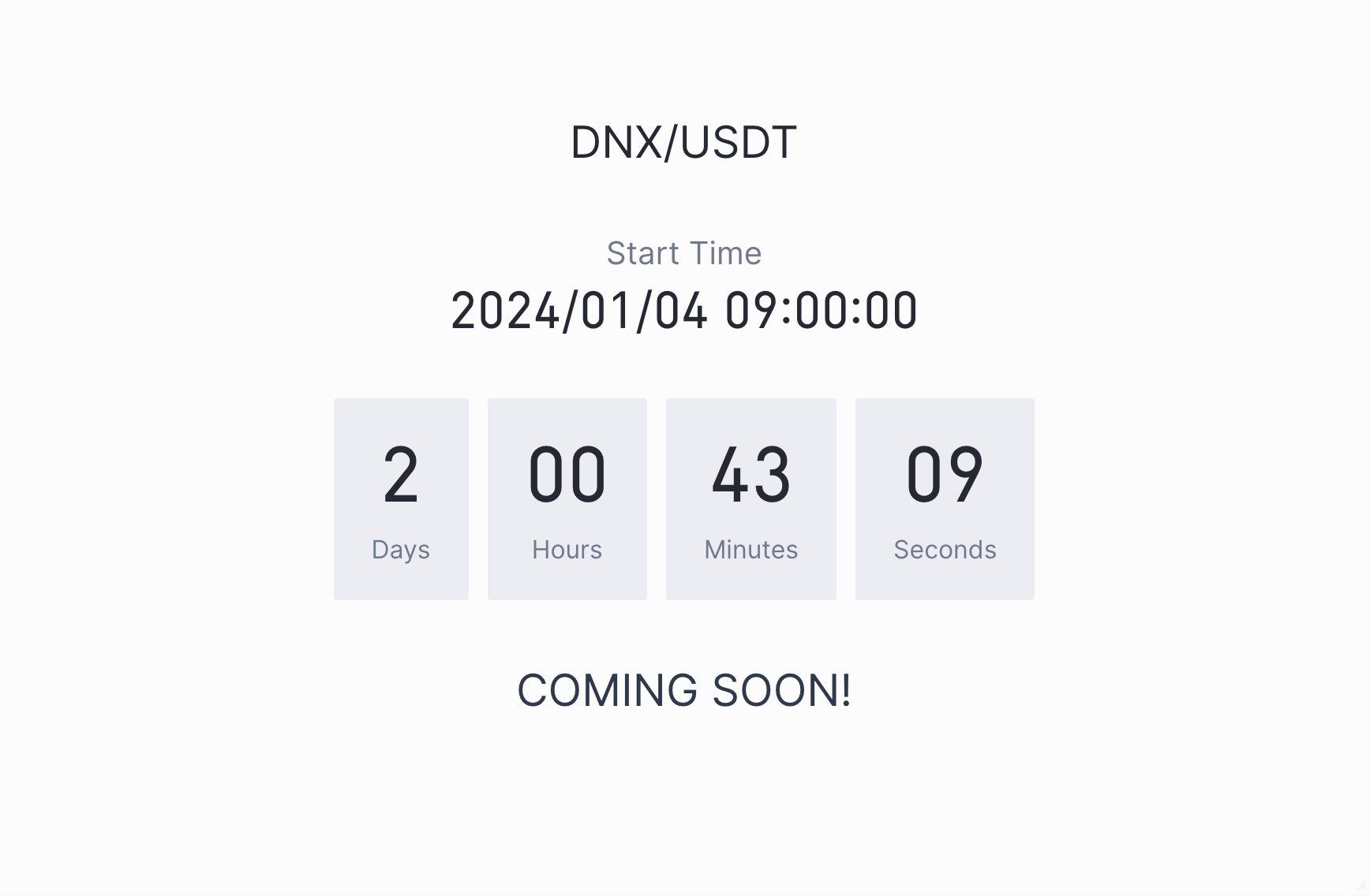

Dynex (DNX) Listing on GATE.IO: A New Chapter for the Crypto Community!

•

Dynex (DNX), an emerging player in the cryptocurrency market, has recently announced its upcoming listing on GATE.IO, a significant development for the digital asset. This listing, scheduled for January 4th, 2024, at 08:00 AM UTC, is set to open new avenues for the token, potentially enhancing its visibility and accessibility…

-

BlackRock Reschedules Seeding of Its Bitcoin ETF to January 5th!

•

In a recent strategic move, BlackRock, the global investment management corporation, has announced the rescheduling of its initial $10 million seeding for the much-anticipated Bitcoin Exchange-Traded Fund (ETF) to January 5th. This decision comes amidst growing interest and speculation in the cryptocurrency market. BlackRock’s Bitcoin ETF Plan Market Implications Conclusion…

-

The Bitcoin Pump Led by CME: A Sign of Insider Knowledge and ETF Approval?

•

The cryptocurrency market is abuzz with the recent Bitcoin pump, notably led by the Chicago Mercantile Exchange (CME), where Bitcoin’s price was approximately $1400 higher than on Coinbase. This significant price discrepancy suggests that a major player, possibly with insider knowledge, is influencing the market, hinting at potential upcoming developments…

-

Anticipated SEC Approval for Spot Bitcoin ETFs: A Turning Point for 14 Asset Managers!

•

In a potentially groundbreaking development for the cryptocurrency market, the U.S. Securities and Exchange Commission (SEC) is expected to notify 14 asset managers about the approval of their applications for spot Bitcoin Exchange-Traded Funds (ETFs) as early as next week. This decision could mark a significant milestone in the integration…

-

Indonesian Police Crackdown on Bitcoin Mining Operations: A Detailed Analysis!

•

In a significant move against unauthorized cryptocurrency activities, Indonesian police authorities have recently shut down ten Bitcoin mining operations. The crackdown, which involved accusations of electricity theft amounting to nearly $1 million USD, highlights the growing regulatory actions against illegal crypto mining activities. Details of the Shutdown Implications of the…

-

JP Morgan’s Role in BlackRock’s Bitcoin ETF: A Turnaround from Bitcoin Ban to Key Player!

•

In a remarkable shift in stance, JP Morgan, once a vocal critic of Bitcoin, has been named as a key player in BlackRock’s Bitcoin Exchange-Traded Fund (ETF). This development is a significant indicator of the changing attitudes of major U.S. banks towards cryptocurrencies. JP Morgan’s Involvement in BlackRock’s Bitcoin ETF…

-

Grayscale’s Bold Move: Filing an Amended S-3 for GBTC’s Transformation into a Bitcoin ETF

•

Grayscale Investments, a leading digital currency asset manager, has recently made a significant move in the cryptocurrency market by filing an amended S-3 registration statement with the U.S. Securities and Exchange Commission (SEC). This filing is aimed at converting its Grayscale Bitcoin Trust (GBTC) into a spot Bitcoin Exchange-Traded Fund…