Category: Cybercrime

-

114 Scams In 45 Days, 200 Stolen ETH – One Address.

•

A scammer creates dubious Memecoins with strange messages every day. He sends the stolen Ethereum to Coinbase. According to “online detective” ZachXBT, one scammer launched around 114 projects in the past 45 days alone.

-

Two Suspected Crypto Fraudsters Tracked Down!

•

After a severe crypto fraud in which a 41-year-old man lost around €10,000, two suspects have now been identified. They are a 31-year-old Albanian and a 43-year-old Kosovar. They will be charged with aggravated fraud.

-

Ontario Man ‘Devastated’ After Losing His Home And Nearly $500,000 In A Crypto Scam!

•

An Ontario man says he is “devastated” after investing his entire life savings in an investment scam he became involved in through a YouTube video he saw.”I’m devastated. It ruined me, and my savings are gone,” said Stephen Carr of Meaford, Ontario. Online investment fraud continues to be a significant…

-

Malware Spread Via Google Ads Drains NFT Influencers’ Entire Crypto Wallets!

•

Malware hiding behind a sponsored ad link on Google siphoned thousands of dollars worth of cryptocurrencies and NFTs from an influencer’s wallet. The NFT influencer with the Twitter handle “NFT God” claims to have lost a “life-changing amount” of his net worth in non-fungible tokens (NFTs) and cryptocurrencies after accidentally…

-

U.K. Police Faced With $1.5B Crypto Fraud “Epidemic!”

•

Over the past year, cryptocurrency fraud has increased by 32% in the U.K. This is part of a larger “fraud epidemic” that began during the pandemic as people moved their financial activities online, according to a Financial Times report. Crypto-related losses totaled £226 million (or $272 million) from October 2021…

-

Unit21 Launches FinTech Fraud DAO To Combat Cybercrime!

•

Unit21 and other U.S. consumer fintech community members have joined forces to launch the Fintech Fraud Decentralized Autonomous Organization (DAO). Participating fintechs include Brex, Chime, PrimeTrust, Yotta and Airbase. This decentralized network uses a collaborative approach to data sharing to detect and combat fraud. The DAO is expected to process…

-

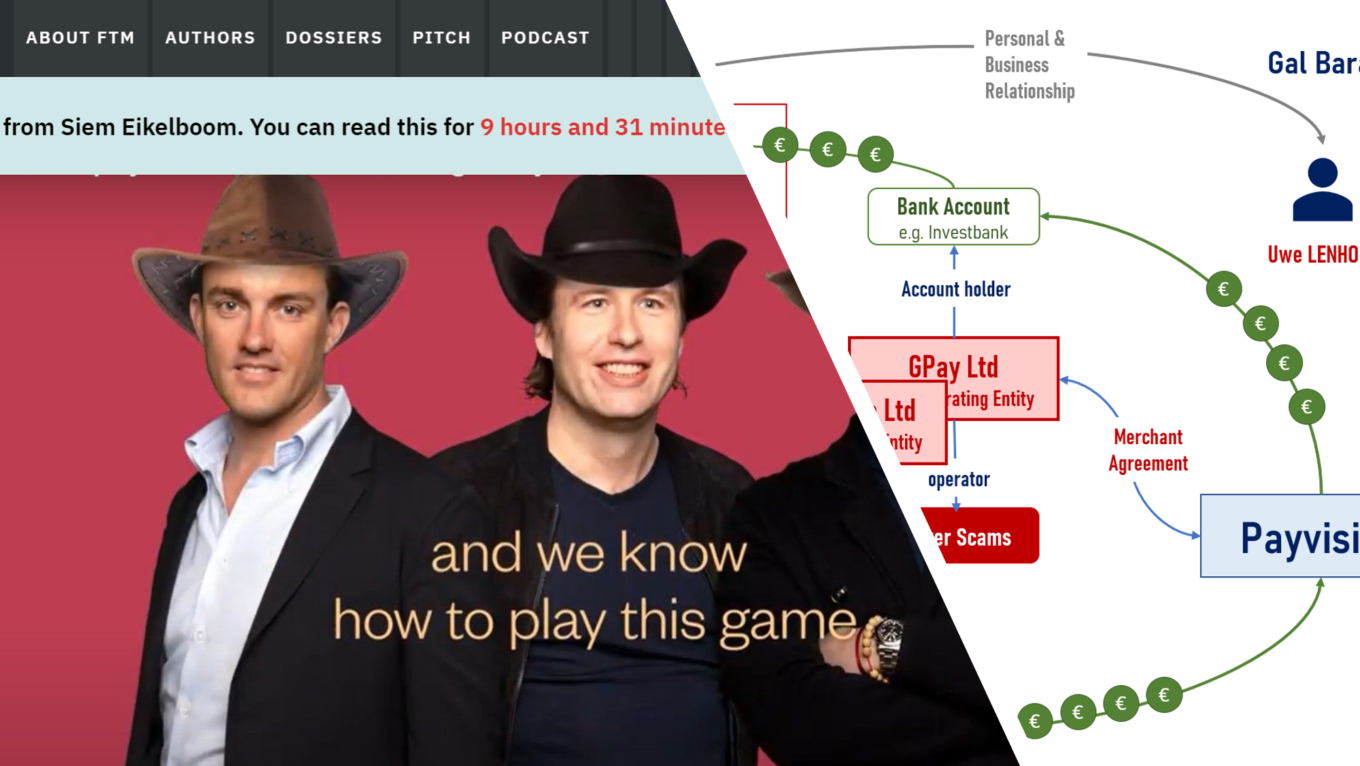

Wanted: Vanished Serbian BoomBill Allegedly Stole Millions From Its Merchants!

•

The vanished BoomBill was the trading name of the Serbian Boom Financial Management DOO, registered in Belgrade. It was a merchant of record or master merchant of Xcepts and allegedly used a fake individual and a fake company to receive an account from Xcepts. Boom had many sub-merchants, one of…

-

Maximum Money Mobility, Fraud Protection, And Money Laundering!

•

An interesting report of Money Mobility Tracker®, a PYMNTS and Ingo Money collaboration, presents a survey that shows that customers of financial institutions (FI) expect both maximum money mobility and fraud protection. The faster money moves, the greater the risk of fraud but consumers typically resist fraud prevention measures, mainly…