Category: Money-laundering

-

FBI And Ukraine Seize Nine Exchange Domains For Money Laundering!

•

On 25 April 2023, nine crypto currency exchanges alleged to have aided cybercriminals were seized by the U.S. Federal Bureau of Investigation (FBI) and Ukrainian law enforcement agencies. Authorities alleged that these exchanges enabled cybercriminals to evade anti-money laundering laws.

-

Law Enforcement Crashed ChipMixer, The World’s Largest Crypto Money Laundering Service!

•

German and US authorities, supported by Europol, seized Bitcoins worth around $46 million In a coordinated international takedown of ChipMixer, a darknet cryptocurrency “mixing” service responsible for laundering more than $3 billion worth of cryptocurrency since 2017. The service laundered the money from illicit activities, including ransomware, darknet markets, fraud,…

-

Anti-Money Laundering FinTech Hawk AI Raises $17 Million!

•

Money laundering is an enormous problem for societies and economies. More than two trillion US dollars are laundered every year. Economic fraud has increased by more than 37% in high-growth markets in the last twelve months. Munich-based fintech Hawk AI, which supports banks and financial service providers in the fight…

-

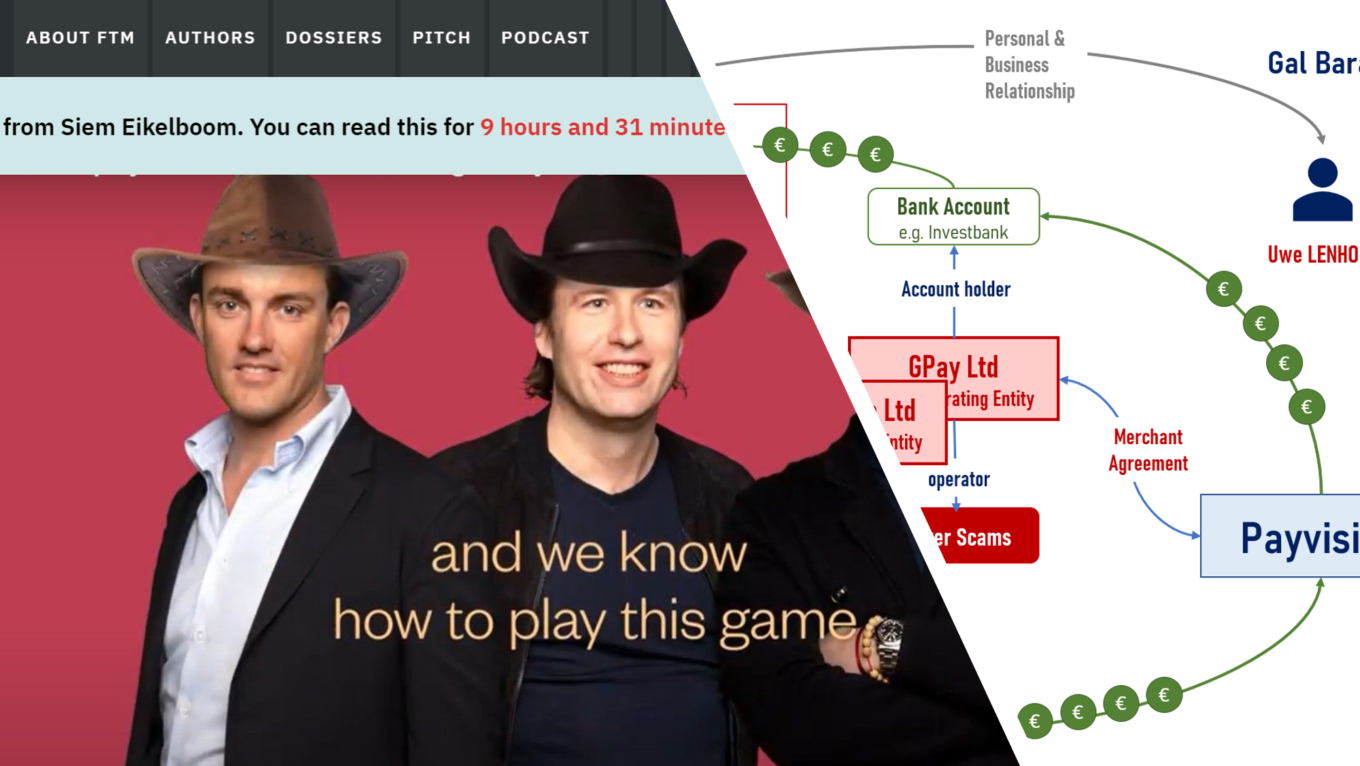

Bulgarian Crypto Scheme Nexo Under Investigation in Over Alleged Money Laundering!

•

Amid the official announcement that the Bulgarian crypto lender is under investigation, Nexo insists that it has followed AML and KYC rules. Crypto lender Nexo has become the subject of a large-scale investigation in Bulgaria as prosecutors probe possible money laundering, tax violations, computer fraud, and other crimes.

-

US: Coinbase to Pay $100 Million to Settle Money-Laundering Investigation

•

The largest U.S. crypto exchange Coinbase has accepted a multi-million dollar fine for allegedly being too lax in its anti-money laundering precautions in New York State. The company will pay a total of $100 million (€94 million) as part of a settlement, the New York financial regulator DFS announced yesterday.…

-

Leonteq Defends Itself Against Allegations Of Money Laundering!

•

Fintech Leonteq defends itself against accusations from the media that the company has enabled money laundering and tax evasion. Derivatives provider Leonteq has again denied allegations concerning two products it issued. A series of investigations had not revealed any evidence that would justify accusations of aiding and abetting money laundering…

-

Breaking! Reuters Report Accuses Binance Of Crime Facilitation!

•

Reuters published an interesting report about the world’s largest crypto platform Binance. According to the report, Binance processed transactions totaling at least $2.35 billion stemming from hacks, investment frauds, and illegal drug sales between 2017 and 2021. Allegedly, in 2019 Binance processed criminal funds totaling $770 million.