Search results for: “payabl”

-

Former Wirecard Satellite Payabl And The German Online Gambling Business!

•

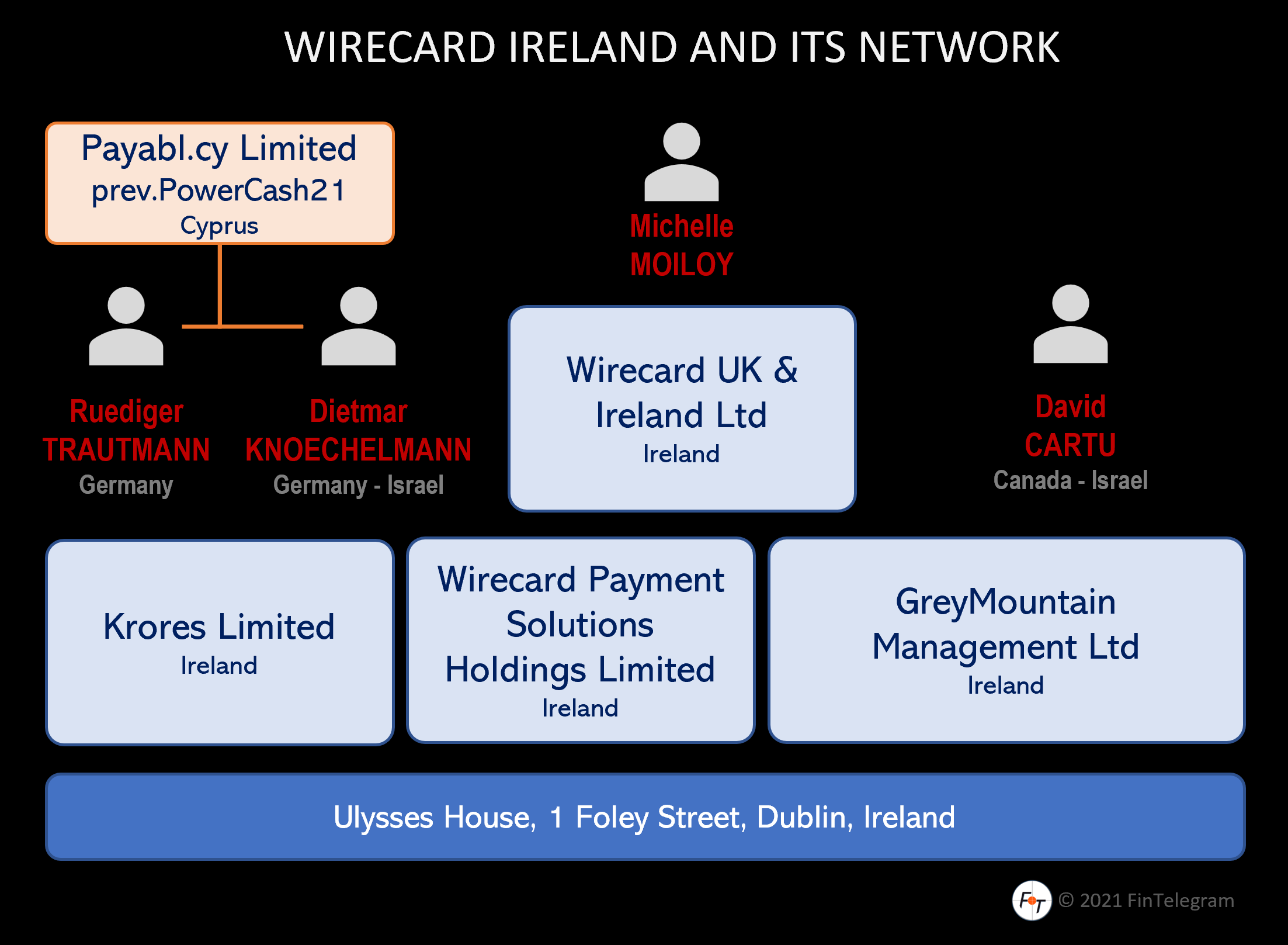

The Payabl Group, founded by former Wirecard executives Ruediger Trautmann and Dietmar Knoechelmann and his wife Ayelet Fruchtlander Knoechelmann in or around 2010, is the resulting company from the merger of former Wirecard satellites. The high-risk payment processor regulated by the Central Bank of Cyprus, is evidently focused on the…

-

Cyprus-Based High-Risk Payment Processor Payabl Induced in PayCom42 Listing!

•

Payabl (previously Powercash21) is a regulated Payments Institution and merchant service provider specializing in acquiring, issuing, and mobile Payments with a license granted by the Central Bank of Cyprus with license No: 115.1.2.9/2018. Payabl is a principal member of Visa and MasterCard with the acquisition and issuance of certifications and…

-

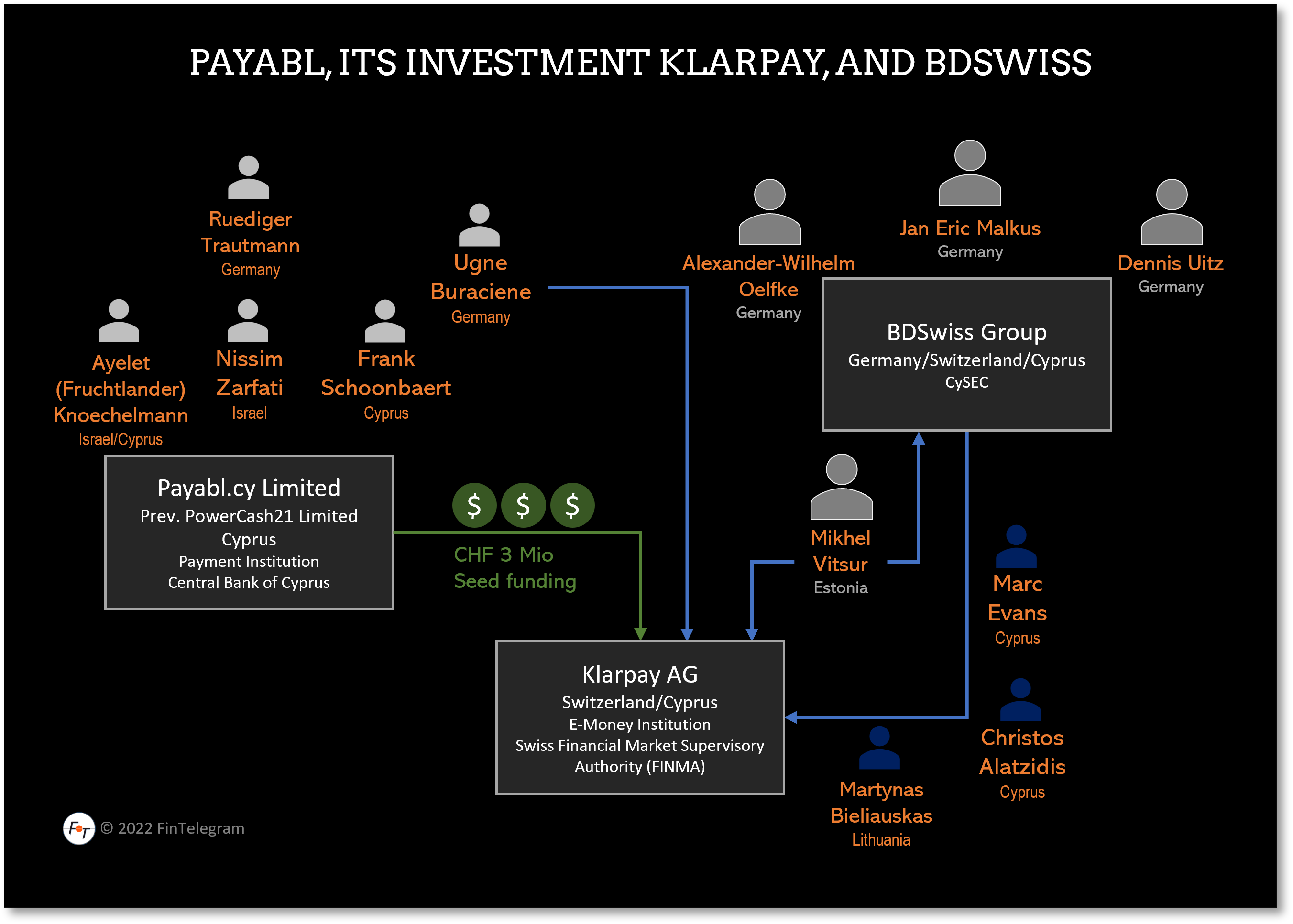

Cyprus-Based Payabl Led Million Investment in BDSwiss Spin-Off Klarpay!

•

The former Wirecard managers and partners Ruediger Trautmann, Ayelet (Fruchtlander) Knoechelmann, Frank Schoonbaert, and the Israeli Nissim Zarfati founded the PowerCash21 Group around 2010 with several legal entities in different jurisdictions. Sometime over the last couple of months, the PowerCash21 Group reincarnated into Payabl and recently led a CHF3 million…

-

•

Sentipredict Markt 🔮 Sentipredict Markt Frage: Lädt… Status: – Contract-Adresse: Betrag in USDC: ✅ Wette auf JA ❌ Wette auf NEIN 💰 Auszahlung holen

-

Five Interesting And Safe PayTechs Of 2022

•

The crypto scene is on alert after the collapse of the third-largest crypto exchange FTX. Allegedly, more than a million people have lost their money. A crisis of confidence has broken out. There is also a crisis in the FinTech segment, where some companies could soon run out of money.…

-

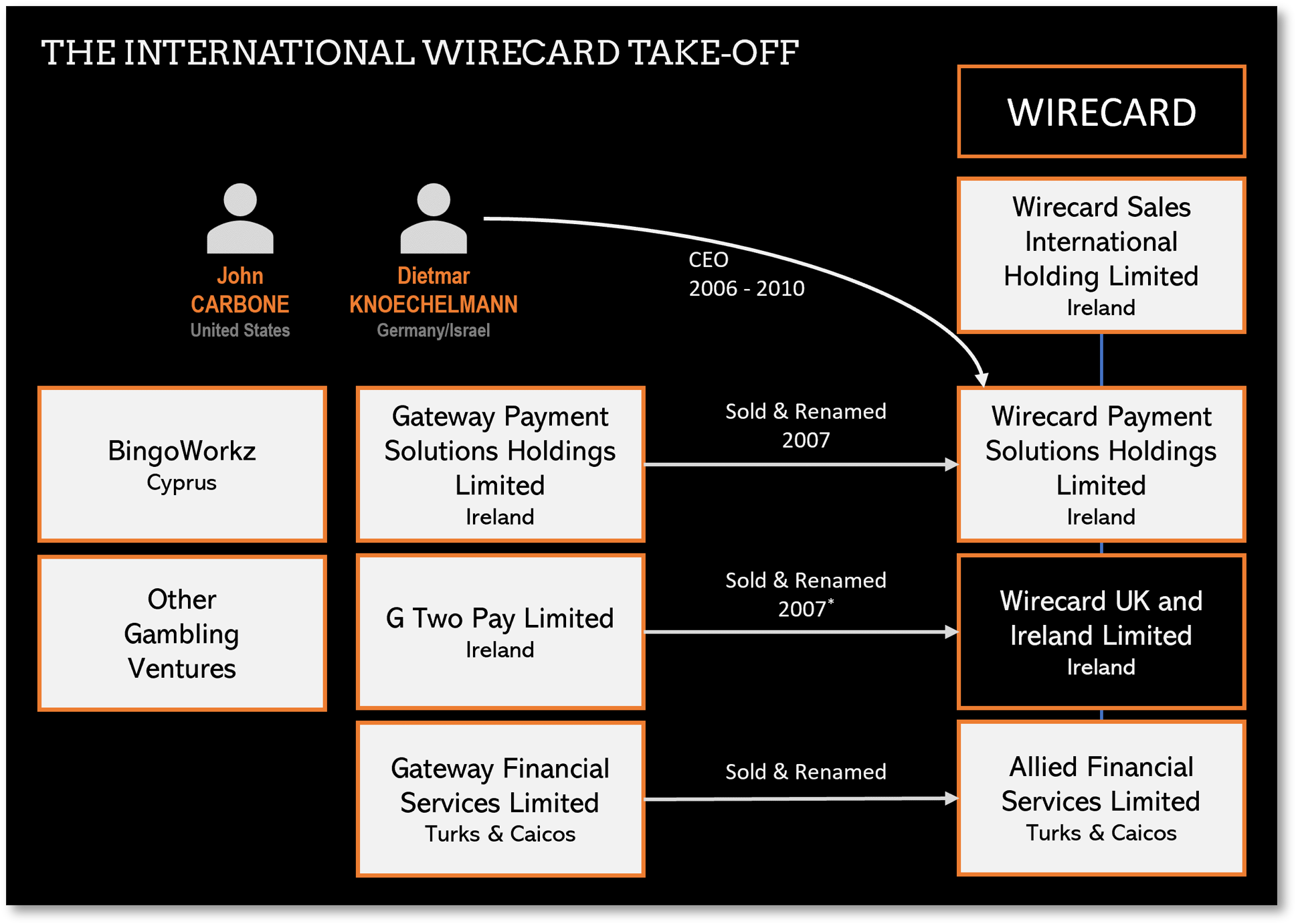

FinTelegram Uncovers The Beginnings Of Collapsed Wirecard!

•

According to the latest FinTelegram report, Wirecard was a local German payment processor until 2007. The international take-off started with the acquisition of Trustpay International AG and the two payment veterans Ruediger Trautmann (2005) and Dietmar Knoechelmann (2006). Wirecard acquired companies from them in complicated and secretive transactions, creating a…

-

Swiss Neobank Klarpay Focused On Digital Merchants And Social Media Influencers!

•

Swiss fintech Klarpay is focused exclusively on e-commerce, digital merchants, and social media influencers. It offers cross-border payment acceptance and remittance solutions, including access to multi-currency IBAN accounts, global payment acceptance, and digital disbursement services. Founded in 2019 by the BDSwiss co-founder Mihkel Vitsur, Klarpay was one of the first…

-

Searching The Wirecard Millions? FinTelegram’s Investigative Journey To Find Answers!

•

FinTelegram launched a new series about the search for the vanished Wirecard millions. The only big question at Wirecard was and is where around €1.9 billion remained. The Wirecard collapse in 2020 triggered one of the biggest financial scandals in Germany. While founder and CEO Markus Braun is still in…