Category: High-Risk Merchants

-

Explaining The Business Model Of High-Risk Payment Processors

•

High-risk payment processors provide payment processing services to merchants engaged in high-risk businesses, such as online gaming, adult entertainment, and short-term loan providers. These businesses are considered high-risk due to the potential for fraud, chargebacks, and regulatory compliance issues.

-

Wirecard Was The House Bank For Companies Behind Youporn And Pornhub!

•

When Commerzbank terminated the account of the porn company Manwin, Wirecard was on the spot. The German fintech did business with the porn industry for longer than ex-CEO Markus Braun portrayed it to the outside world. Wirecard found its first customers in the gambling and porn industries. Over the years,…

-

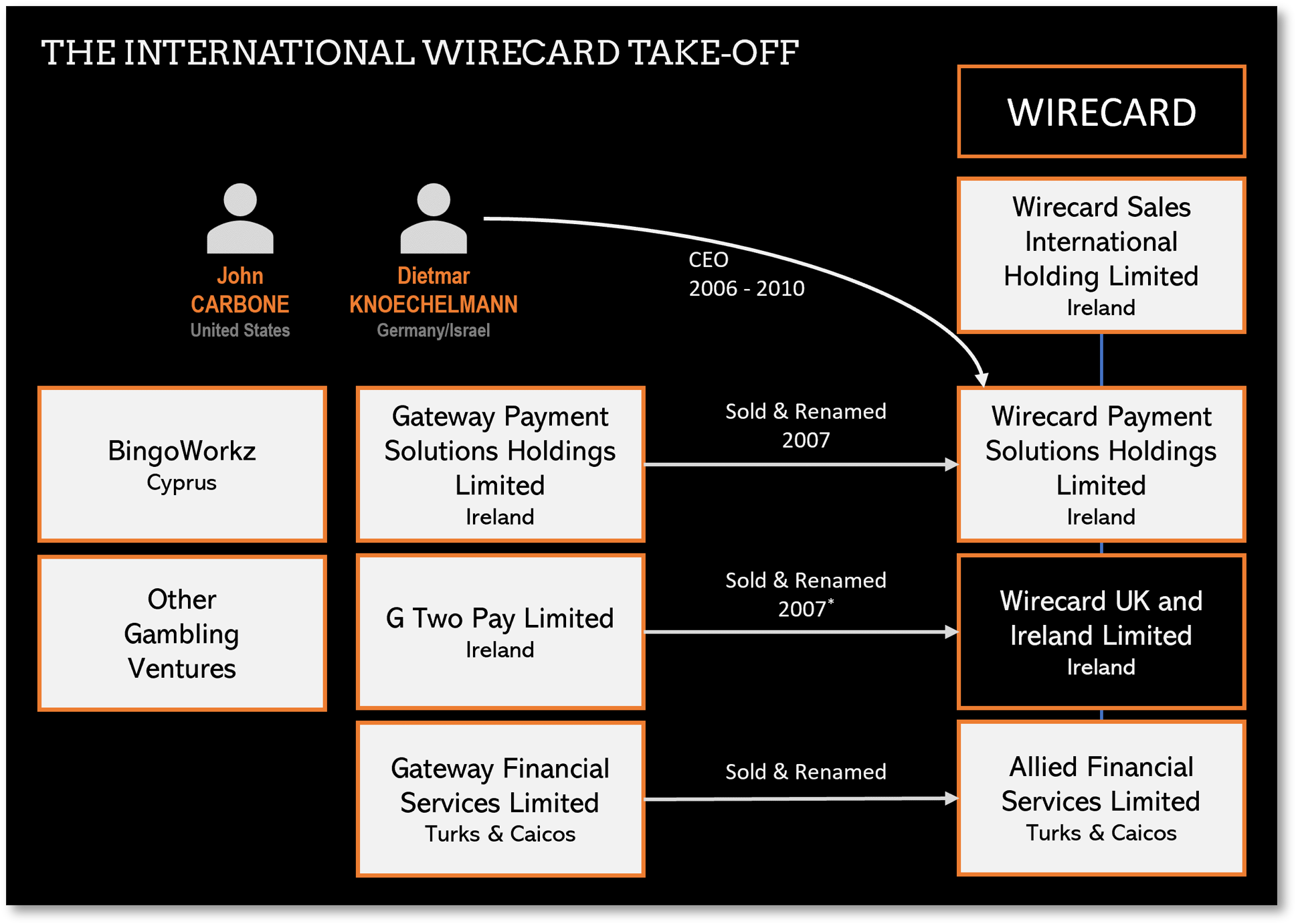

FinTelegram Uncovers The Beginnings Of Collapsed Wirecard!

•

According to the latest FinTelegram report, Wirecard was a local German payment processor until 2007. The international take-off started with the acquisition of Trustpay International AG and the two payment veterans Ruediger Trautmann (2005) and Dietmar Knoechelmann (2006). Wirecard acquired companies from them in complicated and secretive transactions, creating a…

-

High-Risk Payment Processor Fasto Listed On PayRate42

•

The cyberfinance rating agency PayRat42 listed the high-risk payment processor and merchant services provider Fasto a/k/a Fasto Payments, which is doing business via legal entities in the U.S. and Estonia. PayRate42 included Fasto in its “Green Compliance” list.

-

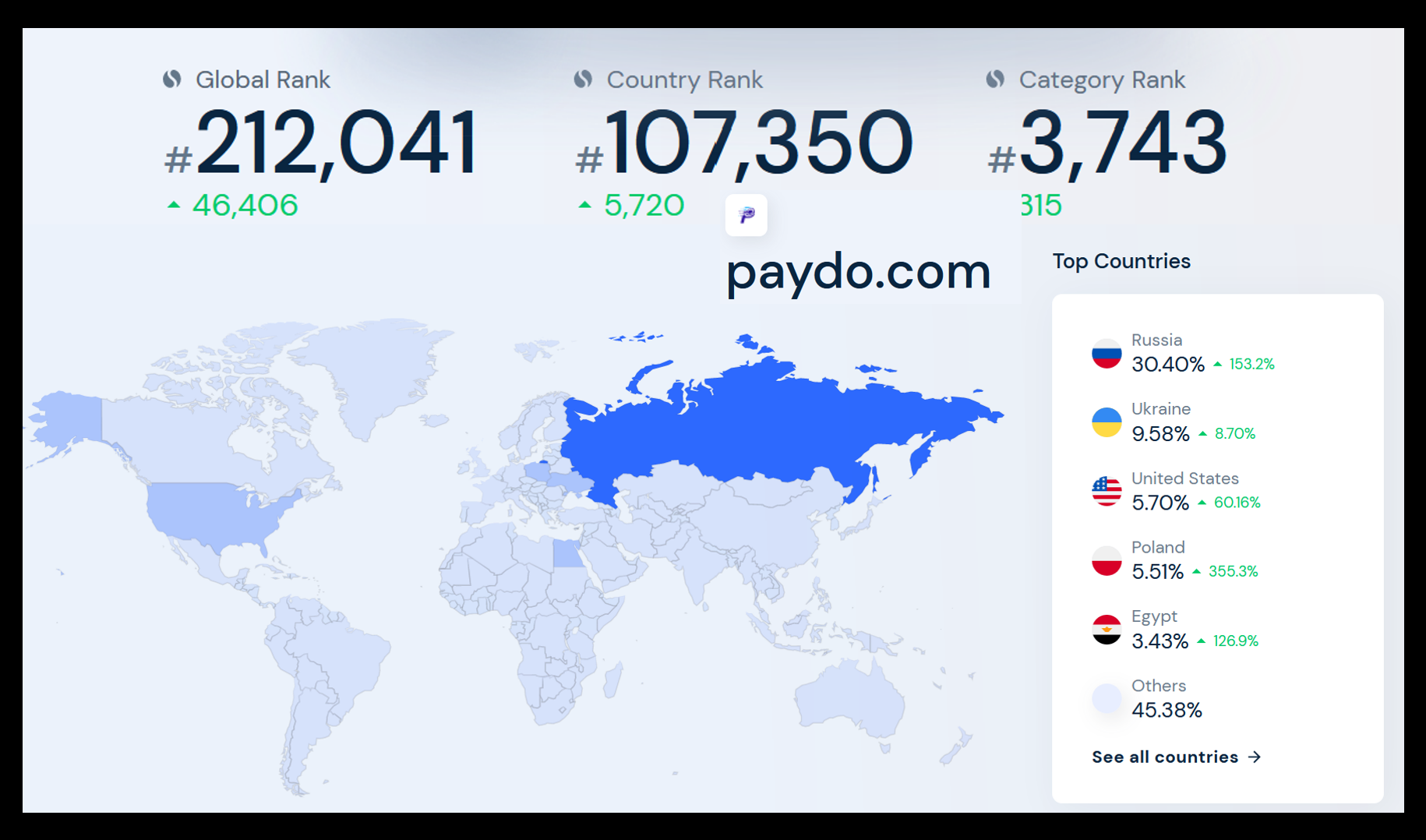

FCA-Regulated Payment Processor PayDo With Explosive Growth In Russia!

•

FinTelegram published the initial review of the FCA-regulated EMI and high-risk payment processor PayDo, controlled by the Ukrainian Sherii Zakharov. The payment processor is apparently heavily engaged in Russia, where many of its website visitors come from. Here is our initial review of PayDo.

-

Former Wirecard Satellite Payabl And The German Online Gambling Business!

•

The Payabl Group, founded by former Wirecard executives Ruediger Trautmann and Dietmar Knoechelmann and his wife Ayelet Fruchtlander Knoechelmann in or around 2010, is the resulting company from the merger of former Wirecard satellites. The high-risk payment processor regulated by the Central Bank of Cyprus, is evidently focused on the…

-

Cannabis Fintech Bespoke Expands BNPL Base In The Cash-Poor Industry!

•

Fintech company Bespoke Financial plans to expand its “buy now pay later” service for cannabis businesses in California and Massachusetts later this year, its CEO George Mancheril said Thursday. The push comes after a successful pilot in July that allowed cannabis retail stores to buy products from producers using the…

-

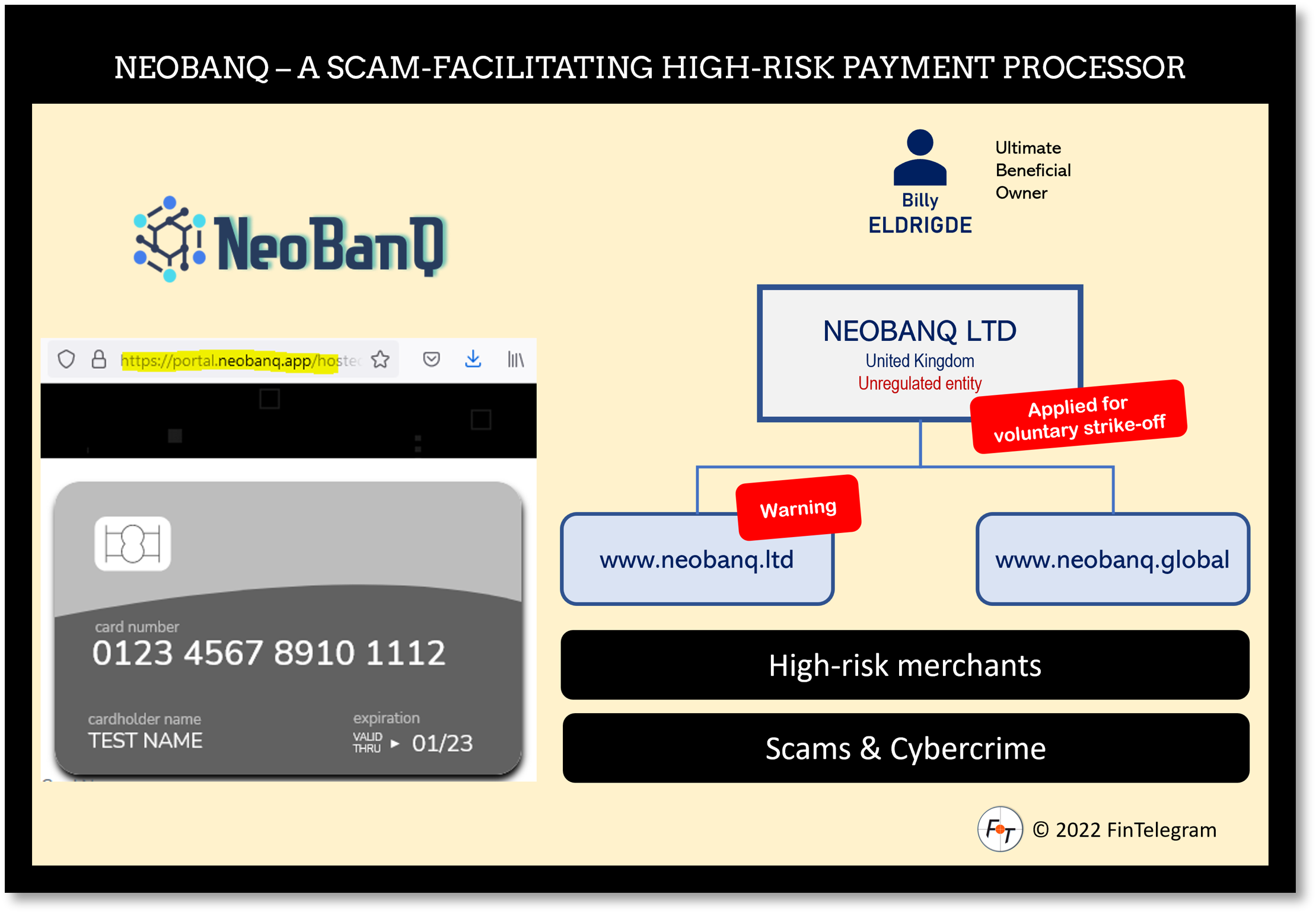

High-Risk Payment Processor NeoBanQ Filed For Strike-Off

•

High-risk payment processors have an inherent tendency to disappear. Unfortunately, very often with their merchants’ money. This is what happened with the Indian-British iPayTotal, which filed for a voluntary strike-off in October 2020. However, the Companies House suspended the strike-off over the objection of a creditor. The UK High Court…