In the dynamic landscape of cryptocurrency markets, the focal point of discussion among investors and traders alike is Bitcoin’s (BTC) current pattern of movement within a symmetrical triangle, suggesting a consolidating market on the brink of a decisive breakout. As observed, BTC has been testing the upper echelons near the $67.3k mark, yet it faces a stout resistance that has yet to be decisively overcome. This technical formation, a convergence of the asset’s highs and lows, is converging towards an apex, a point historically known for resulting in a significant price movement in either direction.

Integrating the current market sentiments, there’s a pervasive belief that a pullback to $69k might be on the horizon, potentially to gather liquidity before a more substantial move. However, this perspective isn’t universally shared. The viewpoint put forth suggests that many traders have been optimistically positioning buy orders around the $60k region, anticipating a dip to $58k that would present a lucrative buying opportunity. These expectations, though, have not come to fruition, leaving many to maintain a theory that is yet to be validated by recent price action.

PayNews42’s analysis leans towards a bullish outlook, propelled by macroeconomic factors. The U.S. government’s recent move to prevent a shutdown, signified by the bill signed by President Biden, has been interpreted as a positive development for the traditional financial markets, which may have a correlated effect on the crypto market. A stable economic environment often serves as fertile ground for investment in riskier assets like Bitcoin, as it reinforces the investor confidence that is critical for a market recovery or rally.

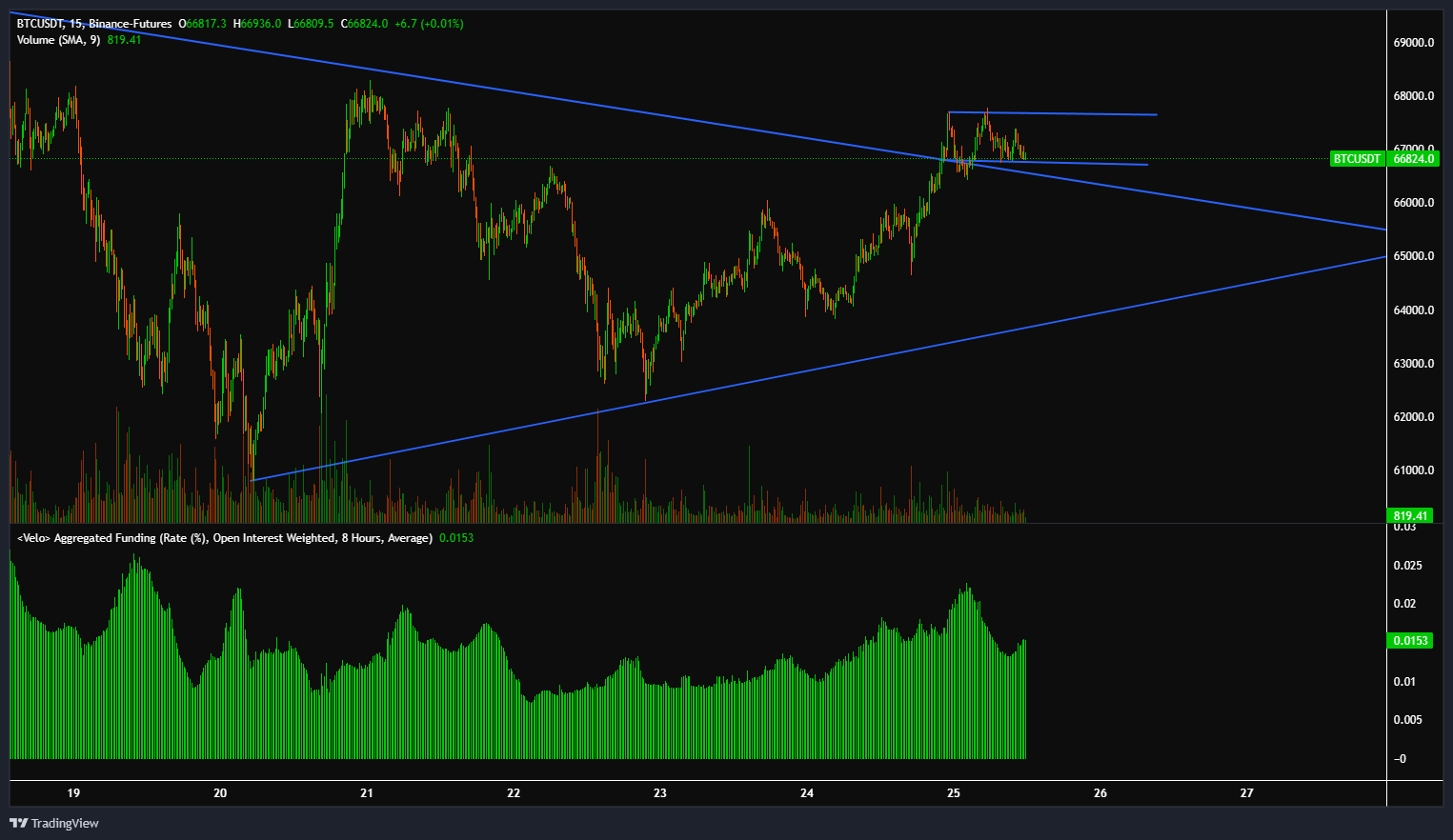

When examining this Bitcoin chart, we observe that Bitcoin has formed a symmetrical triangle, which accordingly suggests that a significant movement in one direction is imminent.

However, last night we created enough momentum to break upwards. As we can also see, we are now consolidating between the $67.7k level and the $66.7k level, likely until the U.S. market opens.

As of now, all Bitcoin-related entities in pre-market are showing strong gains – we must wait and see. Yesterday, we did not close the CME gap, hence some believe in a strong pullback to the $63.8k level—this is not a necessity but a possibility! On the positive side, the funding rates are low for the current price level, and indeed, there’s an increasing amount of short liquidation volume accumulating, possibly indicating an impending short squeeze.

The anticipation of strong performance from the SP500 in response to political stability could lead to a deferment in a potential correction, setting the stage for a continued bull run. PayNews42 projects a potential surge towards the $80k to $85k mark for BTC, before transitioning into a correction phase anticipated to span several months, possibly aligning with the summer slowdown, which historically has been a period of reduced volatility and market consolidation.

Drawing parallels to the past, the analysis notes the resemblance to the 2021 market cycle, where Bitcoin peaked in April and bottomed out in May, only to claw back gradually. Such cyclic patterns are a common feature in cryptocurrency markets, often reflecting the psychological and strategic behaviors of market participants.

From a short-term perspective, the key to sustaining this bullish outlook hinges on BTC reclaiming the $63.7k price level. This would represent the breaking of the downtrend and the establishment of a higher high, signaling a continuation of the uptrend and possibly paving the way to new all-time highs.

However, the forthcoming ETF data poses a wildcard. Substantial inflows could fortify the uptrend, while significant outflows might tilt the scales towards a bearish development. The market remains at the mercy of these influential factors, which could swiftly redefine the current narrative.

To encapsulate, the interplay of technical patterns, trader expectations, and macroeconomic undercurrents weaves a complex tapestry that defines the Bitcoin market trajectory. The blend of historical precedents, current market sentiments, and forward-looking projections provides a multi-faceted outlook, with a cautious yet optimistic tone suggesting the path ahead for Bitcoin may well tread through highs and lows, with the potential to ascend into new bullish territories, while remaining vigilant of the ever-present potential for retracement and correction.

Leave a Reply