Category: Payments

-

Fintech Geopagos Expands Its Operations In Latin America!

•

LATAM fintech company Geopagos has added Paraguay as the 16th country in which it will operate in the LATAM region. This is part of an aggressive expansion plan that has been exponential in recent years and has been supported since the second half of 2022 by a first investment round…

-

Paytech Startup Link Receives $20 Million In Series A Funding!

•

U.S. paytech startup Link has received $20 million in a Series A funding round led by Valar Ventures. Co-founders Eric Shoykhet and Edward Lando say the fresh money comes in addition to an undisclosed $10 million seed round last year led by Tiger Global and joined by Amplo, Pareto Holdings,…

-

New Payment System Enza Launches In Africa!

•

The African fintech Enza has launched its platform. The fintech’s provides a token-based, cloud-native, and API-first platform with the focus on providing the richest possible API environment for easy integration. According to McKinsey, the electronic payments market in Africa is expected to grow by about 150% between 2020 and 2025.

-

Australian Payment System Till Payments Lays Off 120 Employees!

•

Australian paytech company Till Payments has reportedly laid off 120 employees, about 40% of its workforce, as part of a major restructuring that has also seen the company appoint three new board members. Employees in the UK, North America, Australia and New Zealand were told that high inflation and challenging…

-

J.P. Morgan Backs Indian PayTech Company ISG!

•

JP Morgan has invested strategically in leading Indian payments solutions provider In-Solutions Global (ISG). The company processes more than 17 billion transactions annually for its clients through its proprietary GeniusTM Payments-as-a-Service (PaaS) platform. It offers a market-leading stack and scalable capabilities that simplify the payment capture process, resulting in easy…

-

PayTech Native Teams Receives €2 Million To Support Remote And Flexible Workers!

•

Despite the depressive fintech environment, London-based Native Teams (website), a payment platform for mobile and flexible workers, has received €2 million in a seed round. The round was led by Eleven Ventures, one of the leading early-stage VCs in Southeast Europe. Other leading funds also participated in the round, including…

-

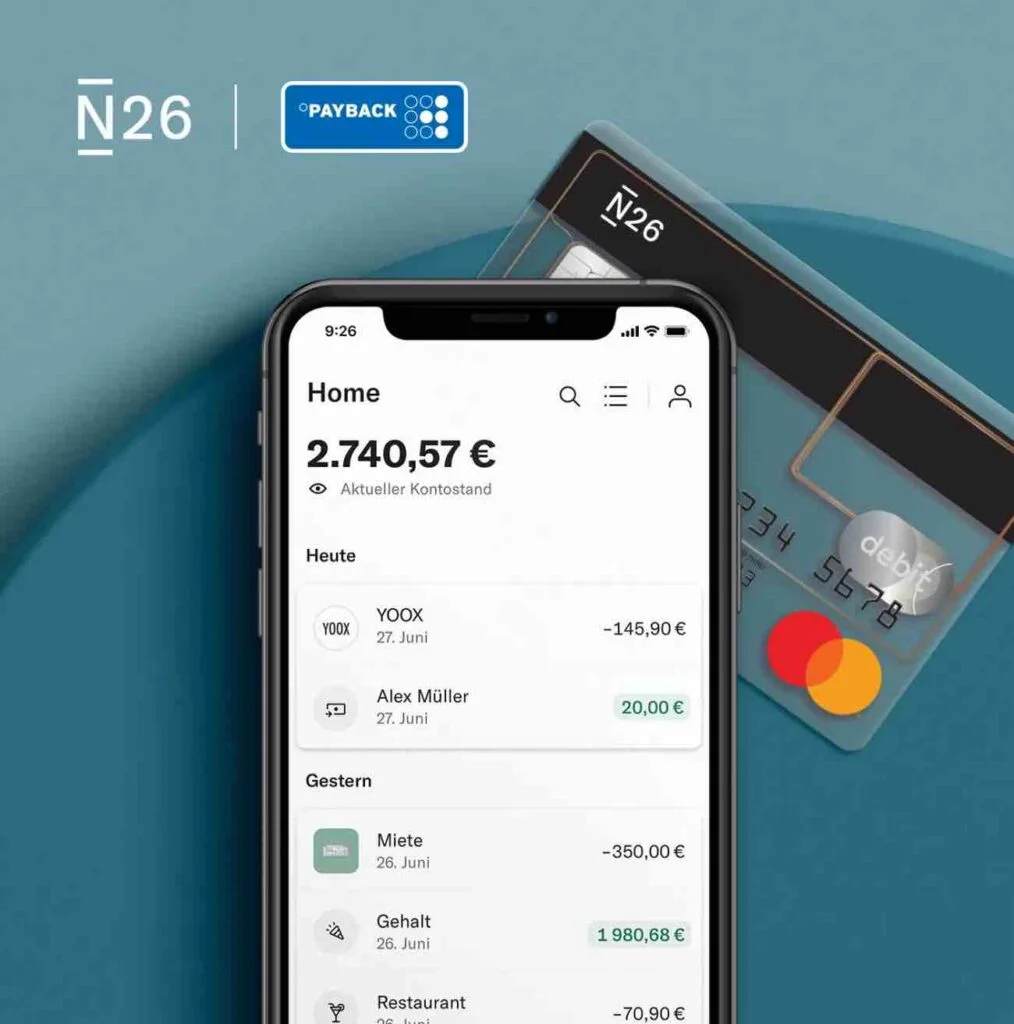

Payback Kicks Out N26

•

Payback users can usually convert their points into money. This is done via SEPA transfer to a checking account. However, this is currently no longer possible at N26, as “Mobiflip” reports. If an N26 IBAN is stored, users only receive the message “Please check the IBAN entered”. Until recently, the…

-

SNB Vice President: “Cash Is Not A Given!”

•

At a time when cash is being used less and less, and large banknotes, in particular, are increasingly being phased out, the Swiss National Bank is standing firm. SNB Vice President Martin Schlegel sees an essential function for this “traditional form” of transaction and store of value.

-

Hong Kong FinTech Company XanPool Is Looking To Expand In Europe And Latin America After Raising $41 Million!

•

XanPool, a cross-border payments infrastructure provider, is accelerating its expansion plans in Europe, the Middle East, North Africa and Latin America after raising $41 million from investors led by London-based Target Global this year. The Hong Kong-based startup bucked the global startup funding winter when it received $35 million from…

-

Five Interesting And Safe PayTechs Of 2022

•

The crypto scene is on alert after the collapse of the third-largest crypto exchange FTX. Allegedly, more than a million people have lost their money. A crisis of confidence has broken out. There is also a crisis in the FinTech segment, where some companies could soon run out of money.…