Category: MENA & Africa

-

Egyptian FinTech Money Fellows Raises $31 Million For Expansion!

•

The fourth funding round since 2018 was led by CommerzVentures, Middle East Venture Partners, and Arzan Venture Capital. The company announced on Sunday that Egyptian FinTech company Money Fellows had raised $31 million to diversify its service portfolio and expand in Africa and Asia.

-

McKinsey Expects Fintech Sales In Africa To Increase Eightfold Until 2025!

•

According to McKinsey & Co, revenues for African financial technology companies could rise to $30.3 billion by 2025 – eight times higher than in 2020 – as a growing, young, underbanked population gains more access to the Internet. Financial services revenues in Ghana and Francophone West Africa will grow fastest,…

-

Saudi Central Bank Grants Licenses To 2 New Fintech Companies!

•

The Saudi Central Bank announced Sunday that it had granted licenses to two new financial technology companies to provide payment services in the kingdom. Enjaz Payments Services Co. received a license to provide electronic wallets, while Marta Financial Co. received a grant to offer payment services through points of sale.

-

U.S. Fintech Company Umba Acquires Majority Stake In Kenyan Microfinance Bank Daraja

•

Umba, a U.S.-based digital bank focused on emerging markets, has acquired a majority stake in Daraja, a Kenyan deposit-taking microfinance bank, for an undisclosed amount. Kenya’s monetary authority, the Central Bank of Kenya (CBK), said Umba had acquired a 66.6% stake, which is expected to accelerate Daraja’s digitization.

-

Sudanese Fintech Bloom Gets $6.5M!

•

Bloom (website), a Sudan-based fintech company that offers a high-interest savings account and digital banking services, has secured a $6.5 million seed round funding. That funding round included fintech giant Visa, Y Combinator, U.S.-based VCs Global Founders Capital (GFC) and Goodwater Capital, and UAE-based early-stage venture firm VentureSouq.

-

Magnati Joins Mastercard’s Fintech Express Program

•

Magnati, a MENA payment solutions provider, joins the Mastercard Fintech Express program, which helps FinTech companies issue cards and credentials. Mastercard connects startups with financial institutions such as banks to provide customized solutions, customizable licensing frameworks and a single point of contact for provincial FinTechs to accelerate the adoption of…

-

Ghanaian Fintech Fido Secures $30 Million in Series A Funding

•

Ghanaian fintech Fido (website) has secured $30 million in Series A funding led by Fortissimo Capital and Yard Ventures to enable new products and future expansion. The investment will support the Accra-based company as it aims to launch new products and prepare for future expansion across Africa.

-

Backbase Receives €120 Million And Enters Partnership With Bahrain FinTech Bay

•

Backbase (website) already has some important partners, including the National Bank of Bahrain, ila Bank, Banque Saudi Fransi, Kuwait International Bank and Société Générale. Recently, Backbase raised €120 million in growth equity funding from Motive Partners. The banking platform provider also announced a partnership with the MENA fintech hub Bahrain…

-

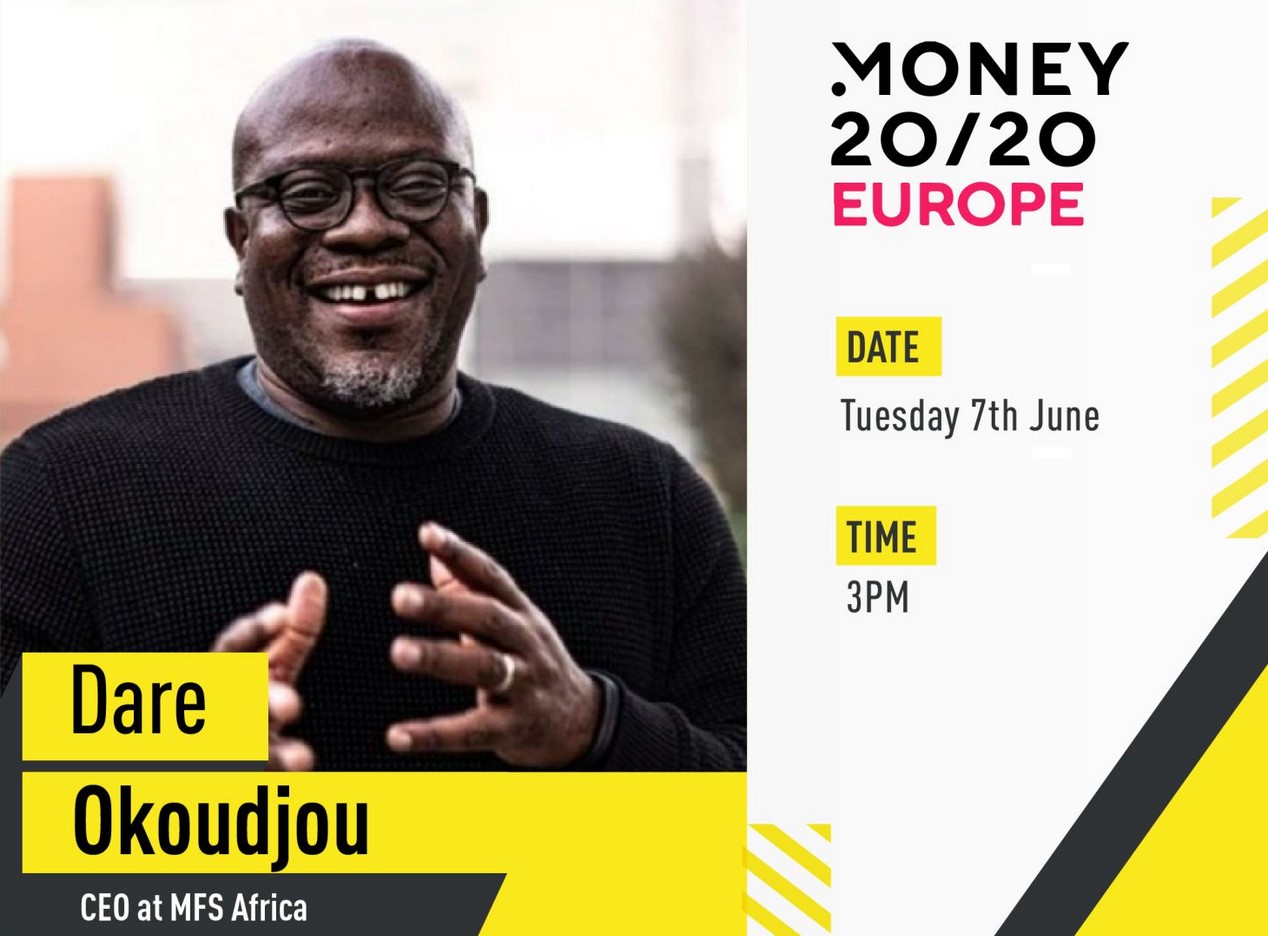

African Payments Company MFS Africa Acquires U.S. Fintech!

•

MFS Africa, a digital payments company, will acquire Oklahoma-based Global Technology Partners in a rare instance of an African group closing a technology deal in the US. The acquisition, which will allow MFS to issue prepaid cards to customers, marks another development in Africa’s fast-growing fintech scene. MFS had paid…